Servicios Financieros

El sector de servicios financieros continúa lidiando con reformas regulatorias, requisitos complejos de gestión de riesgos, amenazas de violación de datos, implementación de tecnologías con buena relación costo-beneficio y requisitos de informes financieros que afectan a todo su negocio.

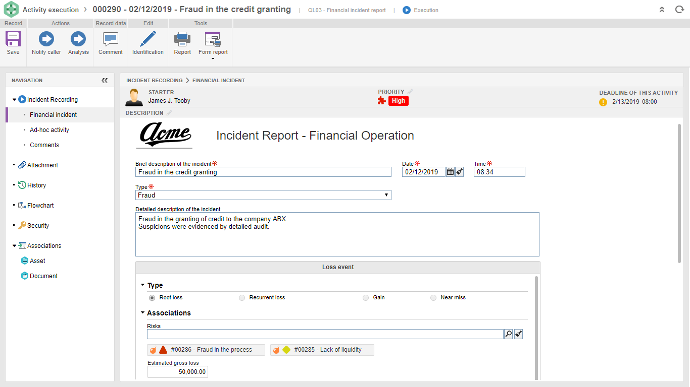

Para atender mejor a sus clientes, las instituciones financieras deben evaluar y controlar los riesgos asociados a la conformidad, fraude, seguridad cibernética y muchos otros. Además de la conformidad, los bancos deben estar atentos a cualquier posible evento de pérdida que pueda perjudicar a sus clientes. Delante de esos desafíos, las instituciones financieras están siendo forzadas a revisar sus estrategias de negocios en todo el mundo.

Soluciones para Servicios Financieros

Reduce el costo de la conformidad regulatoria y ayuda a las empresas del sector financiero a maximizar el éxito, aumentar la productividad, reducir los riesgos y estar en conformidad con varias reglamentaciones globales.

Unifica un abordaje integrado para administrar múltiples aspectos de gobernanza, riesgo, conformidad y auditorías. Puede ser fácilmente implantada en todos los tipos de instituciones financieras, desde grandes organizaciones globales hasta empresas financieras de nivel intermedio, incluyendo bancos centrales, agencias financieras federales, cooperativas de crédito, acreedores, empresas de gestión de activos, bancos del mercado minorista, agencias de corretaje, bancos de inversión y bolsas de valores.

Proyectado para cubrir todos los aspectos críticos de gestión que afectan al sector de servicios financieros. Además, ofrece una interface de usuario altamente funcional y una plataforma configurable que facilita la adaptación de los usuarios a la alta tecnología.

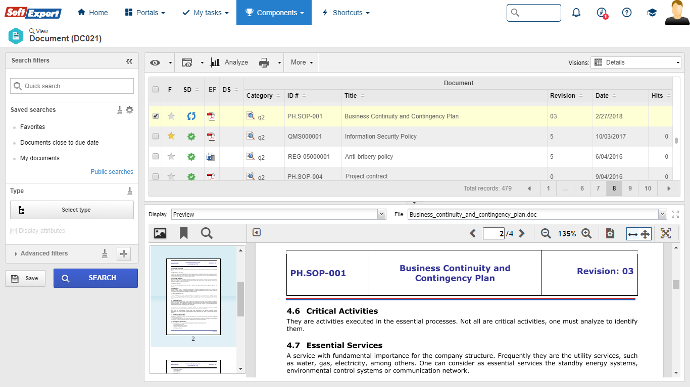

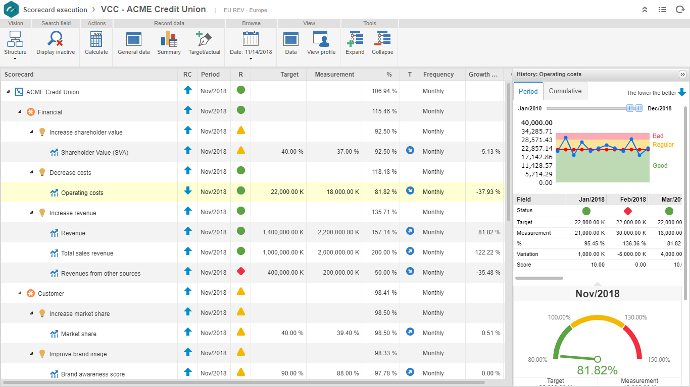

Punto central de acceso a toda la documentación de procesos actualizada, a los principales indicadores de desempeño, a los demás documentos relacionados, como políticas, modelos, procedimientos, además de una plataforma en línea para monitorizar riesgos, controles e iniciativas.

-

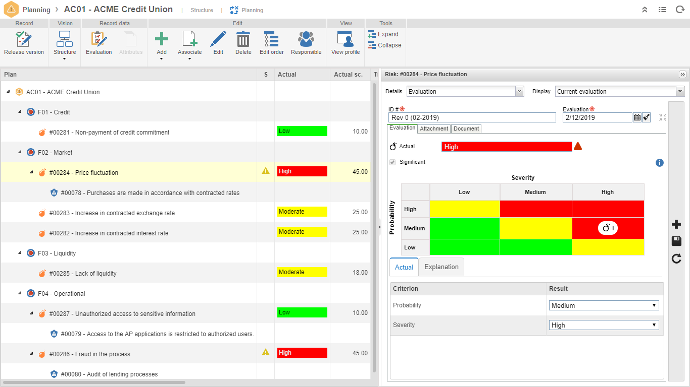

Mejora la madurez en riesgos y gobernanza por medio de un programa integrado y flexible.

-

Establece una taxonomía y nomenclatura de riesgo unificada por medio de una estructura integrada de riesgos.

-

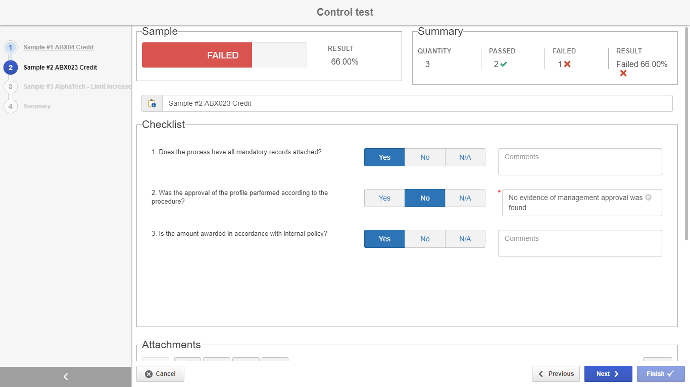

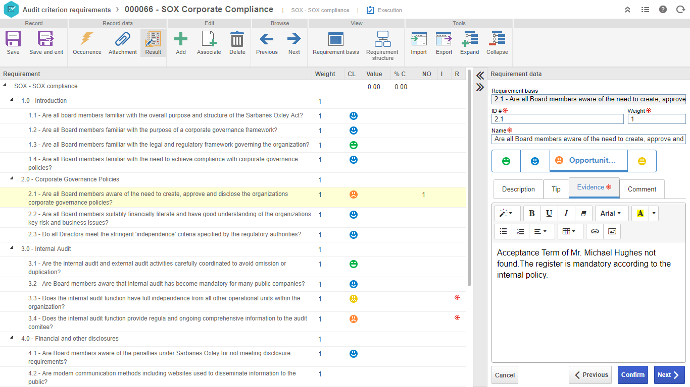

Simplifica la conformidad reglamentaria, usando un único sistema para administrar requisitos de conformidad y auditorías.

- Mejora la ejecución y la monitorización de los controles operacionales.

-

Reduce costos operacionales automatizando procesos manuales y eliminando atrasos en cualquier área que exija flujos de trabajo, controles de procesos y colaboración.

- Reduce el uso de papel a través de la gestión de documentos, obteniendo el máximo beneficio de sus datos no estructurados y trabajando con más eficacia frente a las entidades reguladoras.

- Garantiza la alineación estratégica, administra mejor el portafolio y maximiza el ROI de los proyectos.

- Mejora la productividad y la eficiencia en toda la cadena de valor.

-

Facilita la comunicación y la colaboración en tareas entre unidades de negocios y locales.

-

Ayuda en la toma de decisiones de negocios bien informadas consultando las informaciones más actualizadas en dashboards dinámicos en tiempo real.

- Simplifica todas las tareas relacionadas a la generación de informes financieros.